Operating Leverage in the Age of Efficiency

Demystifying the mantra “do more with less” and its significance.

The phrase "do more with less" has become the mantra of today's macroeconomic climate.

In 2021, we witnessed a bubble driven by irrational exuberance in technology spending, which inevitably burst. In late 2022, Brad Gerstner from Altimeter Capital wrote a letter to Mark Zuckerberg titled “Time to Get Fit,” urging businesses to optimize their operations. Facebook took heed and declared 2023 as the “Year of Efficiency.”

In this blog post, we will explore the concept of operating leverage and its significance. We will also examine Amazon's journey as a case study to understand the importance of revenue per employee and gross profit per employee.

What is Operating Leverage and Why Does it Matter?

Operating leverage is a measure of company productivity that examines how much operating profit is generated for each incremental sale. For instance, if a company can increase sales without significantly raising costs, it demonstrates high operating leverage. This means the business is more efficient, and its profits grow at a faster rate than its expenses.

For example, a software company with high operating leverage can generate substantial profits from each additional sale due to the low variable costs associated with digital products. In contrast, a manufacturing company with lower operating leverage may need to invest heavily in equipment and labor, resulting in smaller profit margins for each additional sale.

Revenue Per Employee: A Proxy for Operating Leverage

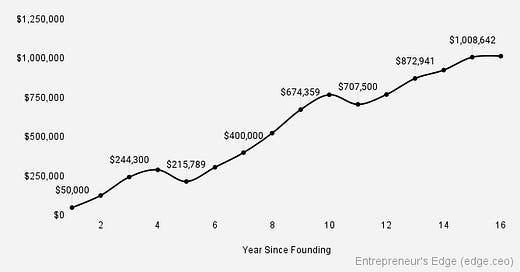

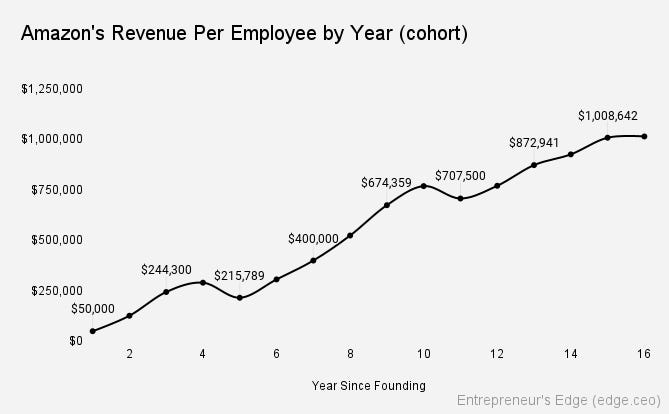

A straightforward way to understand operating leverage is by examining revenue per employee. Amazon, for instance, saw a tremendous increase in revenue per employee from $50K to $1M over its first fifteen years. Ruthless prioritization and technological innovation enabled them to grow revenue while maintaining a flat headcount from 1999 to 2003.

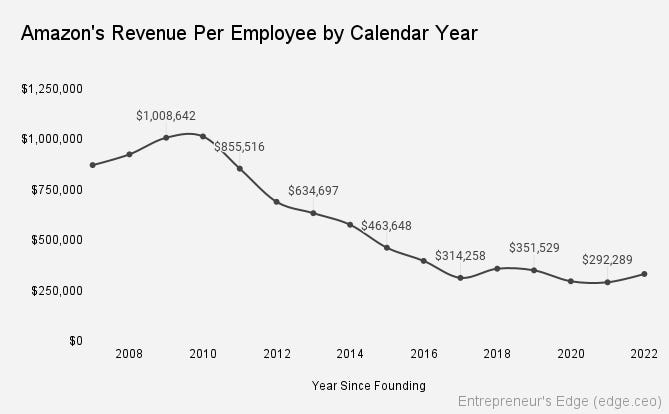

However, over the last decade, Amazon's revenue per employee declined 70% sharply from over $1M to just under $300K per employee. The decline in efficiency represents the difficulty in growing revenue at scale.

Gross Profit per Employee: A More Accurate Metric

While revenue per employee is a great measure of efficiency for zero marginal cost software businesses, it doesn’t always provide the complete picture for every business. It's important to note that Amazon's revenue is more accurately described as GMV (Gross Merchandise Volume), which includes the cost of the product. In addition to this, Amazon has increased its gross profit margin from 23% to 44% over the years. By using the company's gross profit instead of revenue, we obtain a more normalized metric that accounts for variation in business models.

For example, although Amazon's revenue per employee has decreased over time, their gross profit per employee has remained more stable during the same period. This indicates that the company's overall financial health may not be as concerning because Amazon has been adding more profitable revenue with scale (e.g. AWS).

How Can Companies Create Operating Leverage?

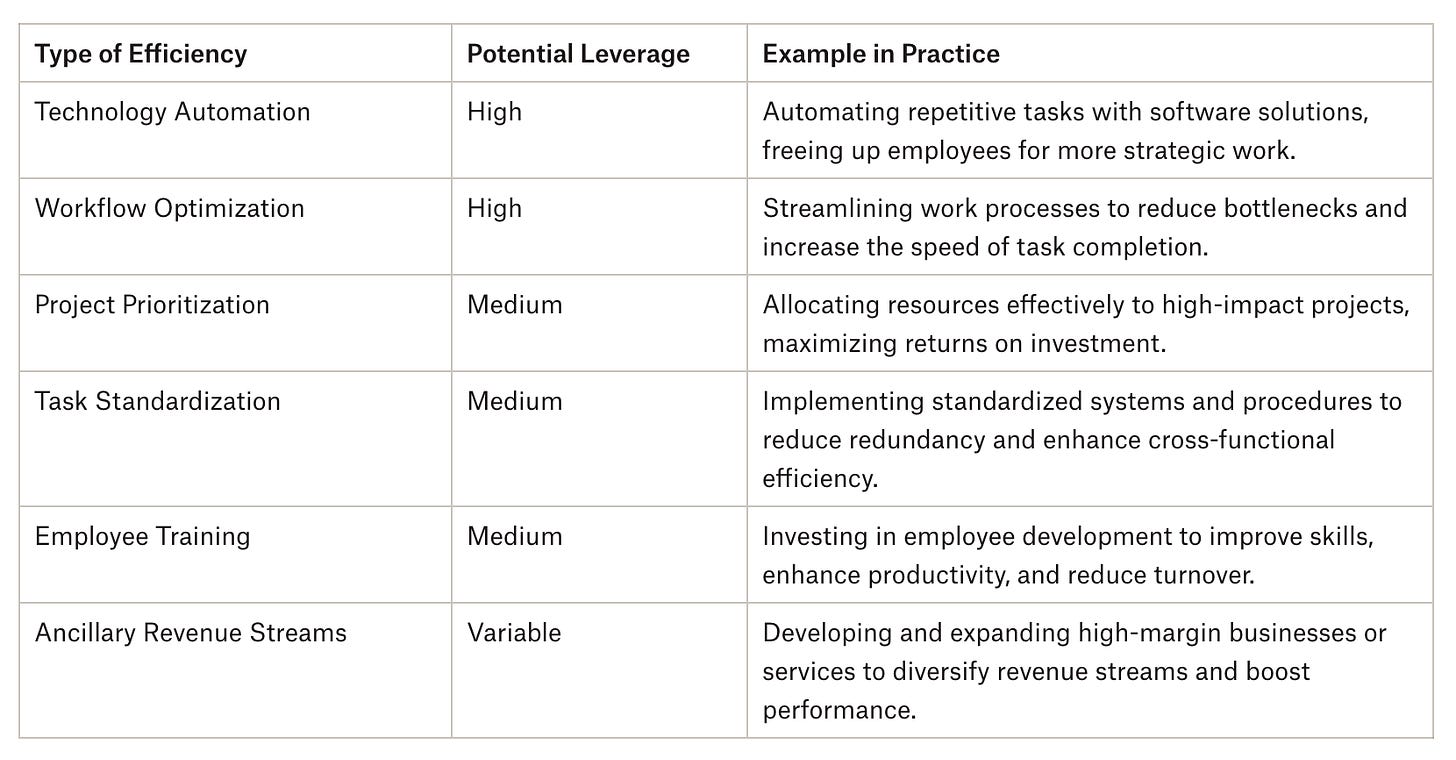

Operating leverage can be created by increasing productivity. Some of the ways it can be achieved is through employee training, task standardization, project prioritization, workflow optimization, and technology automation.

For example, one approach is to invest in automation, which allows repetitive tasks to be handled by software solutions, freeing up employees for more strategic work. Optimization, such as streamlining work processes, can also help reduce bottlenecks and increase the speed of task completion, further enhancing productivity.

In the case of Amazon, a significant contributor to their operating leverage is their ability to generate ancillary revenue through services like Amazon Web Services (AWS). By diversifying their revenue streams and tapping into high-margin businesses, Amazon offset potential declines in other areas and boosted their overall operating leverage and financial performance.

Breaking Even: Gross Profit Per Employee vs. Average Operating Costs Per Employee

A company reaches its break-even point when gross profit per employee equals the average operating costs per employee. For example, if a company has a gross profit per employee of $120,000 and average operating costs per employee of $120,000, it is at the break-even point. This approach is particularly useful for businesses with indirect variable costs and overhead. It also creates a clear milestone that a company can use to orient itself towards profitability.

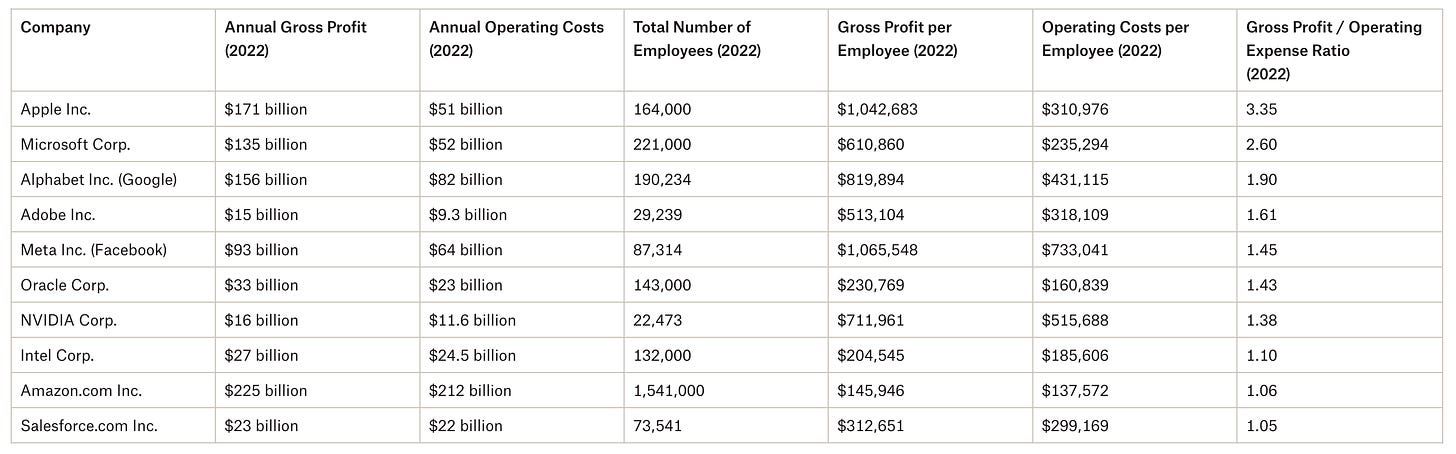

See below for a list of publicly traded companies, their gross profit per employee, and their operating costs per employee.

The Importance of High Operating Leverage

Aiming for higher operating leverage is essential as it enables higher wages for employees, creates value for shareholders, and provides a margin of error to absorb business risk. Conversely, when companies have low operating leverage, it creates an unfavorable situation for all stakeholders involved.

In conclusion, operating leverage is a vital component of business efficiency, and understanding it is key to navigating the ever-evolving economic landscape. By focusing on increasing operating leverage, businesses can ensure sustainable growth and create value for all stakeholders.

Appendix — Reference Data